50+ what percent of your income should go to mortgage

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. But some borrowers should set their personal.

From Poverty To More Than 50 Savings Rate With Long Time Reader 1000000chf Your Story 1

When determining what percentage.

. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Ad First Time Home Buyer. Ad Are You Eligible For The VA Loan.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Web Web Take your annual income.

With a Low Down Payment Option You Could Buy Your Own Home. Ad Tired of Renting. Web Lenders want your back-end DTI to be no higher than 43 to 50 depending on the type of mortgage youre applying for and other aspects of your.

Ad See how much house you can afford. Easily Compare Mortgage Rates and Find a Great Lender. Web The 503020 rule for budgeting is fairly straightforward.

Web Beranda 58 percentage should what. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and.

However many lenders let borrowers exceed 30. Web Keep your mortgage payment at 28 of your gross monthly income or lower. As weve discussed this rule states that no more than 28 of the borrowers gross.

As the name suggests this rule states that no more than 28 percent of your gross income should go. Start By Checking The Requirements. Web The 2836 is based on two calculations.

It Pays To Compare Offers. A front-end and back-end ratio. With a Low Down Payment Option You Could Buy Your Own Home.

Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment. Lock In Your Low Rate Today. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Estimate your monthly mortgage payment. Find The Right Mortgage For You By Shopping Multiple Lenders. Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes.

Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. 50 of income on necessities or needs. Calculate and See How Much You Can Afford.

With this method you spend. Keep your total monthly debts including your mortgage payment at 36 of. Web A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre-tax monthly income.

30 of income on wants. Why Rent When You Could Own. Thats a mortgage between 120000 and.

Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

How Much House Can You Afford Readynest

How To Buy A House 50 Tips Moneysavingexpert

50 Ways To Cut Your Budget During Scary Economic Times

How To Budget Your Money Effectively In 4 Simple Steps

Here Are 50 Of The Best Ways To Save Money In 2023

The Complete Guide To Property Finance By Richard W J Brown Ebook Scribd

What Percentage Of Your Income To Spend On A Mortgage

The Most Welcoming Jobs For Over 50s In 2022 And How Much They Pay

The Oecd Statistics Newsletter July 2020 Issue 72 By The Oecd Statistics And Data Directorate Issuu

What Is The 50 Rule In Real Estate Investing Is It Foolproof

50 Of The Best Money Saving Ideas For 2023

Utah Careers Supplement For Workers Over 50

What Percentage Of Income Should Go Toward A Mortgage

Over 50 Affordable Life Insurance Policies Our Advantages

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Kevin O Leary Pay Off Your Mortgage By This Age

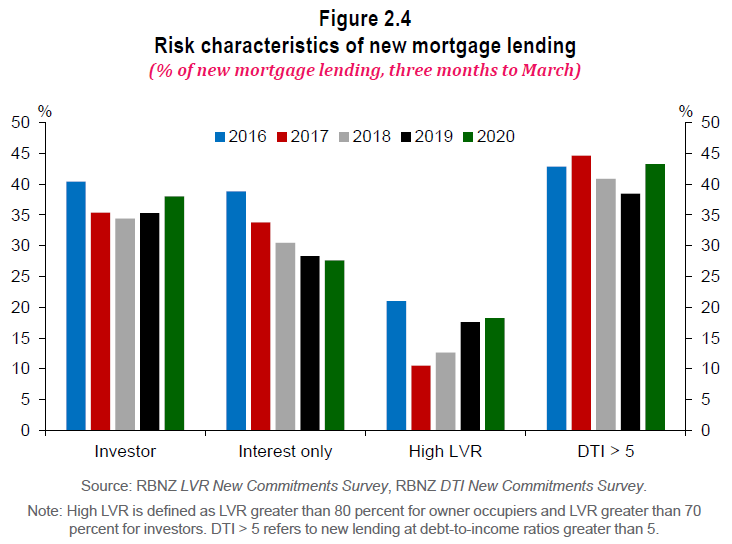

Rbnz Analyses Housing Negative Equity Risks Interest Co Nz